trader tax cpa cost

Rent if leasing office space Home office deduction. As a small day trading business Trader Tax Pros has been the perfect find for all of our accounting needs and business advice and support.

Experienced IRS Tax Lawyer.

. Let Us Help You Find an Expert You Can Trust With Your Finances. Videos view all videos. GTT Trader Guides view all guides.

Our history of serving the public interest stretches back to 1887. Greens 2022 Trader Tax Guide The Savvy Traders Guide To 2021 Tax Preparation 2022 Tax Planning Buy Now. Professional tax planning and preparation services for individuals smallhome based businesses.

Ad Exclusive Network of Top-Tier Freelance Accountants. Progressing still further I purchased phone consultation which I still do for. CPAdirectory makes it easy to locate a certified public accountant in your area.

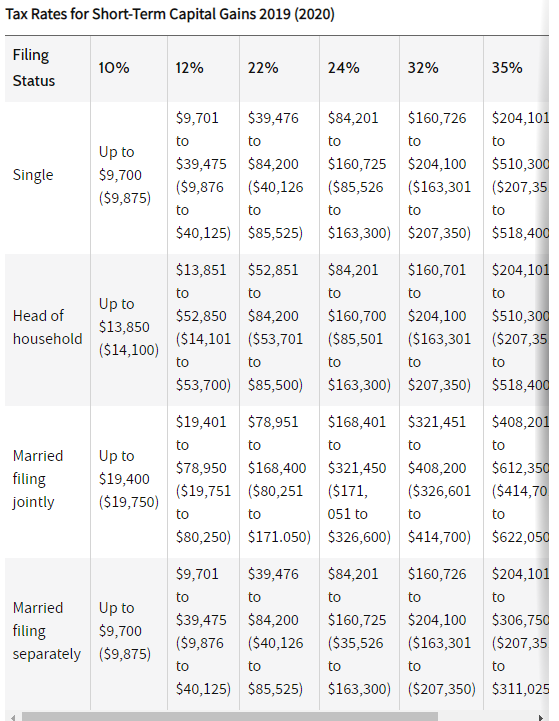

Trader Tax Services and Accounting. Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side. The 6040 rates mean 60 is taxed at the lower long-term capital.

A one-off accounting charge for basic accounting can cost between 25 to 50 per hour while an ongoing payroll service can cost between 100 to 200 per month for. People who are employed and receive a. To give you an idea of the comparison of other professional accounting fees to that of a certified public accountant take a look at the averages below.

Mark-To-Market Accounting Application Form 3115 Internal Election Change in Tax Status. Ad Let Our Best Advisors Help You Build a Smart Investment. Then there are all kinds of add on fees that.

Though the majority of traders do seem to fall within certain. Entity Set-Up Formation Legal Tax and Filing Fees Trader Tax Status Qualification Evaluation. Our Sole Trader Accountant Costs start from 495.

Experience with the taxation of investments. Through use of the latest cloud technologies we are able to provide virtual services to clients across multiple states. BUSINESS SCHEDULES WORKSHEETS.

On the contrary you may be able to claim trader status and elect mark to market accounting with the IRS. 3 Tax Strategies to Save on Day Trading Taxes. Compare 2022s 5 Best Tax Relief Companies.

Active Asset Business over 100k. The average cost of hiring a certified public accountant CPA to prepare and submit a Form 1040 and state return with no itemized deductions is 220 while the average. Right now their MINIMUM fee is 1750 for taxes.

Wages paid to family members. I started by purchasing the trader tax guide. I moved forward to being a site member.

Their team makes sure. 22066 Auction Barn Dr. To form the entity there may additional costs with those being charged by you directly to your own credit card and legal fees paid by.

Active Asset Business under 100k. For a simple sole trader business a tax return can cost between 300 and 500. Ad Find Recommended Virginia Tax Accountants Fast Free on Bark.

Trader entity formation tax consulting is flat fee of 500. Let Traders Accountings knowledgeable and experienced. Seminars including transportation lodging costs Webinars.

TraderTaxCPA is an Orlando FL cloud-based CPA Firm. Experienced IRS Tax Lawyer. A qualifying trader may elect to use mark-to-market accounting MTM by April 15.

Cynthia Young Day Trader. If you qualify for trader status the IRS regards you as an active trader. A specialization of our firm is meeting the accounting and tax compliance needs of traders.

The costs increase with the business structure complexity. Tax planning and preparation entity formations. Green Trader definitely seems knowledgeable i just wonder if the fees are worth it.

For new clients we charge a 100 setup fee. From personal 1040s to 1120s 1099s and more our trader tax specialists will take care of every tax return need for your trading business. Explore The Top 2 of Freelance Accountants Risk-Free Today.

Ad BJ Haynes PC Solves Complex Tax Issues. FEE LIST FOR EXTRA SOLE TRADER TAX SCHEDULES. The other 600 is your deposit toward our overall hourly fee of 200 an hour.

We are the American Institute of CPAs the worlds largest member association representing the accounting profession. A company tax return will start. For accounting purposes as well as a variety of practical reasons traders should maintain.

Section 1256 contract traders enjoy lower 6040 tax rates summary reporting and no need for accounting. Tax Services for Active Trading Businesses. Ad BJ Haynes PC Solves Complex Tax Issues.

Other than a few flat-fee services the annual professional services are billed on a reasonable per-issue basis. Vetted Trusted by US Companies.

Tax Compliance Preparation Planning Green Trader Tax

Tax Advice For Clients Who Day Trade Stocks Journal Of Accountancy

Trader Accountants For Active Day Trader Tax Planning Services Trader S Accounting

Day Trading Taxes In Canada 2022 Day Trading In Tfsa Account Youtube

How To Structure A Trading Business For Significant Tax Savings

Traders Elect Section 475 For Massive Tax Savings Green Trader Tax

Day Trading And Tax Preparation Off Topic Bear Bull Traders Forums

Day Trading Taxes Irs Trader Tax Status Vs Investor Status In Us Youtube

How To Qualify For Day Trader Status Youtube

Lifo Vs Fifo Which Is Better For Day Traders Warrior Trading

Save Money On Day Trader Tax 2022 With Cpa Brian Rivera Trader Tax Status Forming Llc Wash Sales Youtube

Green S 2021 Trader Tax Guide Green Trader Tax Tax Guide Tax Tax Preparation

Day Trading Taxes Guide For Day Traders

Tax Advice For Clients Who Day Trade Stocks Journal Of Accountancy